You may be familiar with the term “back pay” if you or someone you know receives Social Security Disability Income (SSDI). When referring to the Social Security Administration (SSA) “past-due benefits” many individuals use the words “back pay” despite the fact that this is not the official term. The term “past-due benefits” refers to a time frame during which you were medically qualified for disability benefits but were awaiting approval to receive them.

Typically, a disability claim takes some time to process. If an application is initially denied but then appealed, the process takes even longer. However, the SSA will ensure that you receive your rightful benefits. Some people find it hard to understand back pay, but this is why we wrote this article.

What You Need to Know About Back Pay

It is possible to receive back payments all the way back to when you first submitted your application. Let’s take a look at an AARP example to see how this works. Assume that on August 21, 2021, you were unable to return to work due to a severe case of medically diagnosed muscle stiffness. You then applied for SSDI on September 1, 2021, but were turned down. In response to the rejection, you filed an appeal and got a hearing before an administrative law judge.

At the hearing, you will have the opportunity to present evidence to the court in the hopes of swaying their decision in your favor. If the judge agrees, then your disability would have started in August 2021. You should expect the SSA to determine your SSDI benefit amount by looking at your past work and income records.

Let’s pretend that the monthly benefit amount you’re entitled to is $1,000. However, it’s already November 2022, and you haven’t received any payments since August 2021. Here’s when back pay enters the scene. It’s been 15 months since you first became disabled. The SSA will use this date as your onset date. A person must wait five months before receiving SSDI compensation. Once this waiting period ends, SSDI payments will begin, which means they will start the 6th full month after the onset date. With that said, you should expect to receive back pay for ten months.

The SSA’s Policy on Back Pay

Once an SSDI claim has been approved, the SSA will typically pay any late payments in a single lump sum within 60 days. If you retained a lawyer during the SSA’s disability appeals process, the agency would deduct their fees from any back payments due to you, so you should keep that in mind.

The SSA must approve the fee arrangement with your legal representatives, such as a lawyer or advocate, in the beginning. Fortunately, the maximum amount of the fee cannot exceed $7,200 or 25% of the back pay, whichever is less. According to the example we mentioned above, you would pay your lawyer $2,500 out of the $10,000 you received in back pay. This is calculated by multiplying the $1,000 SSDI benefit by the 10 months following the waiting period.

Where Else Can I Get Back Pay?

SSDI is not the only way to get back pay. As a matter of fact, some people may be eligible for back pay from Supplemental Security Income (SSI) as well. SSI is one way that low-income individuals who also meet other requirements can get help from the state. Keep in mind the SSI’s back pay regulations are a little different from SSDI.

With SSDI, back pay begins on the day of eligibility, while with SSI, it begins on the date of application. One advantage of SSI is that there is no waiting period, unlike SSDI, which has a 5-month waiting period. As a result, the calculation for SSI back pay is different from that used for SSDI. Keep in mind that you wouldn’t receive a lump sum if your total back pay was more than the maximum monthly benefit of $943 under the SSI program as of 2024. You would receive it in three equal six-month installments.

How Much Can You Get in Back Pay from SSDI or SSI?

For both SSDI and SSI, it’s crucial that you properly understand how back pay works. The best part about both potential back pay options is that there is no cap on either of them.

Does Receiving Back Pay Affect Your Taxes?

Be mindful that there is some taxation of Social Security payments. This means that if your annual income is above a certain level, a portion of your back pay may be subject to taxation. The Internal Revenue Service (IRS) is aware of this, so it gives taxpayers options to reduce the chance that they’ll owe more in taxes than they should. This is possible because they enable people to recalculate back pay from the previous year and include it in their income for the current year. This is referred to as a lump-sum election.

Some Examples of Back Pay

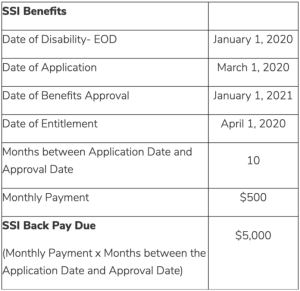

When you become eligible for Social Security benefits, this is known as your “date of entitlement.” Each person’s “date of entitlement” to their back pay is different. There is a difference between SSI and SSDI. This is due to the fact that 5 months after your disability onset date, you will begin receiving back pay from your SSDI payment. Earlier, we provided an example of how SSDI back pay works. Instead, here’s what it looks like when you get your SSI back pay:

Bottom Line

It’s not hard to get your head around back pay. Back pay is the money you receive for the time period between when you submitted an application for benefits and when you received approval for them. This should come as no surprise since the time it takes to get your application approved can take a lot of time. When compared to SSI, which has no waiting period, the SSDI program has a long one (five months). Since each option is different, it’s crucial that you properly understand it. Contact the SSA if you have concerns regarding your back pay.